Apply Online

A Comprehensive Guide to Mezzanine Finance

What is mezzanine financing?

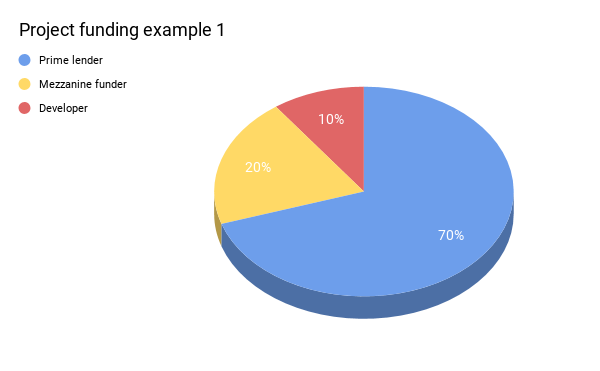

Mezzanine financing is used by property developers to bridge the gap between a development facility or loan and the amount of equity that a developer has available to invest. With a mezzanine fund, developers are able to provide less of their own cash investments to secure project funds.

Mezzanine lenders usually back a development on the understanding and agreement that they will receive full repayment of their initial investment, plus an interest amount which reflects their perceived risk.

The difference between debt, equity and mezzanine financing

Broadly speaking, there are three categories of business funding: debt, equity and mezzanine finance.

Debt

From business loans to commercial mortgages, debt finance is the blanket term that covers most borrowing. The details of debt finance can vary based on the lender’s criteria or the situation of the borrower, but essentially, a business is taking on debt from a lender. Businesses receive funding from a lender in exchange for regular repayments that add up to the borrowed amount plus interest.

Equity

Rather than repaying a lender for borrowed cash, equity fundraising gives developers the option to sell shares of their business to investors – giving their new stakeholders the chance to benefit from future growth of the business. Equity fundraising is a riskier proposition for Investors, as they’ll share any losses that the business suffers. This avenue is usually part of a larger, long-term strategy for venture capitalists and private investors.

Mezzanine

Mezzanine financing is often viewed as a middle ground between debt and equity; combining the risk and reward of equity fundraising with the security and predictability of debt repayments.

A common arrangement of mezzanine funding is that it will essentially act as debt finance that will convert to equity financing. Essentially, a developer will make repayments as normal if things go according to plan, whereas lenders will convert owed repayments to company shares if a business can’t make the repayments.

Another option for developers choosing to use mezzanine financing is to offer shares of the business as a form of collateral for the loan.

The pros and cons of choosing mezzanine finance

Like any form of financing, mezzanine finance has its pros and cons. It’s important to make sure you thoroughly research what is entailed when applying for mezzanine finance so you can judge whether the advantages outweigh the potential risks.

The pros

- Mezzanine finance is flexible and offers various repayment structures and schedules to suit your business

- It can help you acquire the funding you need, making the difference between a funded project and a failed one

- As long as your company continues to grow, it’s very unlikely that you’ll lose outright control

The cons

- If your company’s profits don’t go according to plan, you could risk losing a portion of the control

- The requirements for mezzanine finance can be restrictive in terms of security and personal guarantees

- Mezzanine finance is often more expensive than traditional or senior debt arrangements

Mezzanine financing lending criteria

Typically, mezzanine funding providers will restrict their lending to more experienced property developers who can boast a history of successful projects. Mezzanine finance can be a risky investment for lenders, which is why they have such strict lending criteria to ensure they feel confident in the ability of a developer.

Lending criteria for mezzanine financing include the following:

- Mezzanine Funding is secured by a second charge

- It is essential for developers to be experienced for mezzanine finance to be approved

- Full Detailed planning consent needs to be granted

- Valuation Reports and QS/ MS reports which are instructed by the senior lender can also be utilised by and addressed to the Mezzanine Lender

- Available for residential and commercial property development schemes in England, Scotland and Wales

- Personal Guarantees will be required

How much are mezzanine funding rates?

In most cases, the rates for mezzanine financing start from 1% per month with a 2% facility fee and a 1% exit fee. Like any financing solution, rates for mezzanine funding will vary between lenders and will be based on a project basis, so it’s important you find the right lender for you and your business.

Examples of factors that will affect the rate of your finance include:

- Your experience as a developer

- The size of the deposit you’re investing

- The development location

- The amount of funding being borrowed

- The predicted demand for the finished development

Progressing a mezzanine finance loan

In order for your mezzanine financing application to progress and be approved, there are a number of details that you must provide to the mezzanine lender:

- Applicant details, company name and company phone number.

- Directors and shareholders CV’s or experience details

- Development site address

- Details of senior lender and copy of Senior Debt offer letter

- Copy of the planning consent

- Detailed financial appraisal and cash flow

- Detailed build costs/quote

- Schedule of accommodation

- Full details of the professional team (contractor, architect, structural engineer, CDM co-ordinator etc)

- Procurement method

- Comparable Sales details (or agent’s opinions) to support the GDV

Applying for mezzanine finance

As the UK’s leading development finance and bridging loan specialists, our experts at Positive Commercial Finance can help you find the best financing solution for you and your business.

If you have any questions or would like to learn more about bridging loans, don’t hesitate to get in touch.

Product Types

Quick Enquiry